Calendar Put Spread – Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati . Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all .

Calendar Put Spread

Source : optionalpha.com

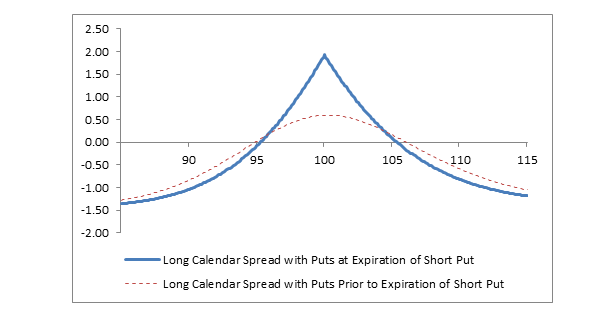

Long Calendar Spread with Puts Fidelity

Source : www.fidelity.com

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

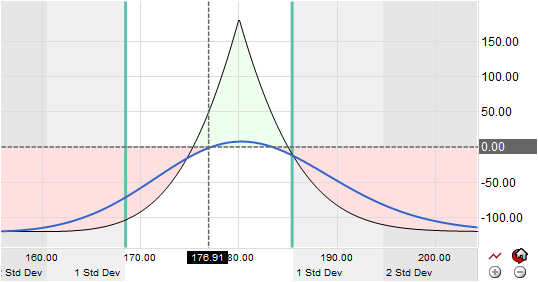

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

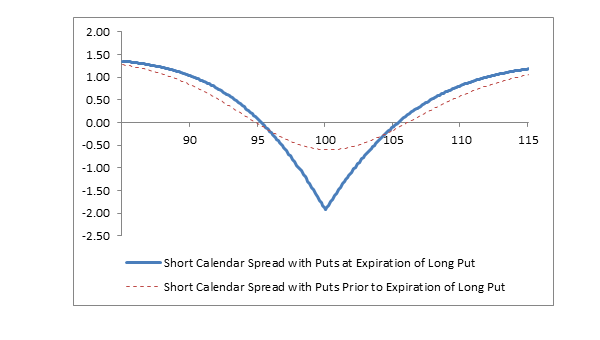

Short Calendar Spread with Puts Fidelity

Source : www.fidelity.com

Calendar Put Spread – Options Edge

Source : theoptionsedge.com

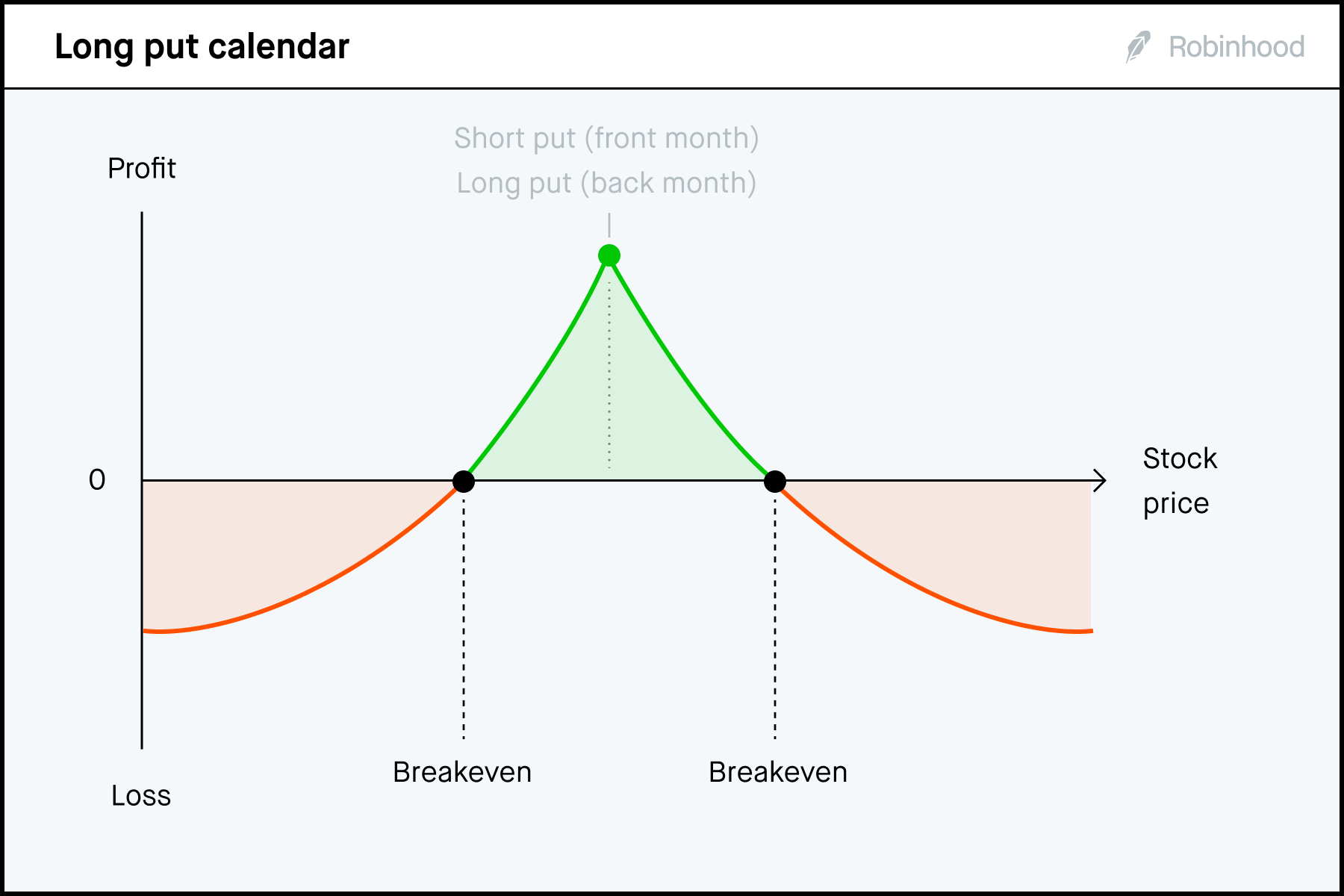

Long Put Calendar Spread (Put Horizontal)

Source : www.optionseducation.org

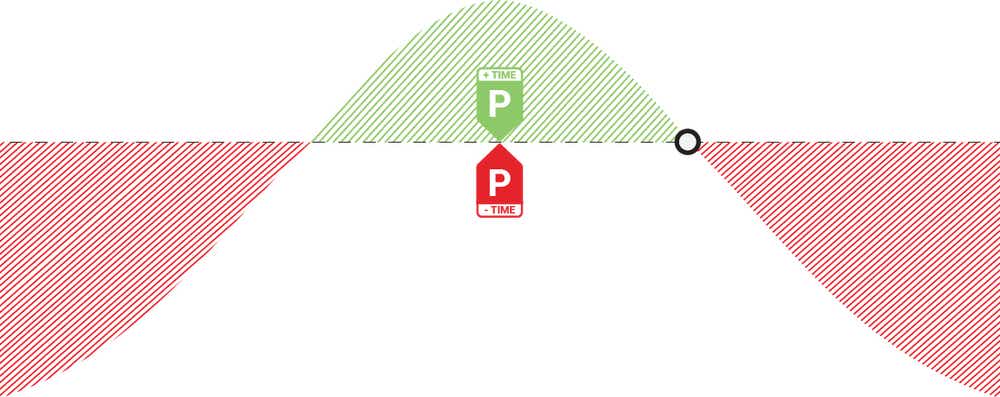

Put Calendar Spread

Source : oahelp.dynamictrend.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

Advanced options strategies (Level 3) | Robinhood

Source : robinhood.com

Calendar Put Spread Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]: This article will focus on the Heating Oil calendar spread. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT . of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to .